No, Canada Isn’t About To Go Off A Fiscal Cliff

Two weeks ago, the Parliamentary Budget Officer, an independent fiscal watchdog that provides cost estimates for the federal government and political parties, released his annual Fiscal Sustainability Report. There is a lot in this report that the media will cover and parliamentarians will consider, so it’s worth taking a few minutes to investigate the report.

Before digging into the report, however, we should note three caveats. First, there is room for disagreement – also among Christians – on how to define fiscal sustainability. The PBO defines fiscal sustainability as “government debt not growing continuously as a share of the economy.” Other countries use slightly different definitions than this one, but most follow similar logic. Other definitions might include different ways of measuring debt or different time horizons, for example. Just because the PBO and other economists use this definition, however, doesn’t mean that this is necessarily the best definition of fiscal sustainability.

Secondly, just because a government’s finances are sustainable in the long term doesn’t mean that they are morally right. The Bible speaks to the morality or wisdom of debt and the responsibilities of government, subjects that we’ve written about in the past from a Christian perspective (here, here, and here). In the end, the civil governments’ finances should be sustainable – that is one moral consideration that governments must consider – but it isn’t a government’s only consideration. Where the money is spent, how much money is spent (both relative to the projects themselves and relative to general income), and how effectively and efficiently it is spent also matters. Overall, though, an excessively large government that is spending sustainably in the long-term isn’t perfect, but it still is better than an excessively large government whose spending isn’t sustainable.

Thirdly, this report must be understood as a long-term planning tool rather than a prediction of what will happen. This is because the PBO estimates what government finances will look like if the government is on “autopilot” and doesn’t factor in what decisions the government might make in the future. Think of it like how you use Google maps on a road trip. Google maps says that it will take me 4 hours and 43 minutes to drive from my home to my in-law’s home. That’s their best estimate, and I use that estimate to plan my trip. But it never takes me 4 hours and 43 minutes. I could speed and cut down my travel time to 4 hours, but, more likely, it will take longer because I will stop for gas or lunch, pick up some food or drinks for my visit, take a slower but more scenic route, or hit a traffic jam due to a car crash or construction. In the same way, the best guess of this PBO fiscal sustainability report almost certainly won’t happen, but it remains useful to help governments plan their future budgets.

Okay, let’s get into it.

The Big Headline

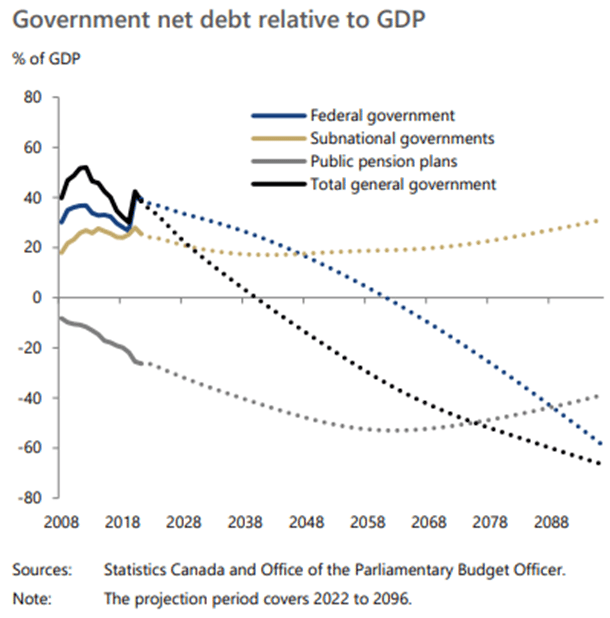

The PBO estimates that the current fiscal policy of the general government sector (which includes all levels of government) is sustainable in the long term. In fact, if the federal government doesn’t initiate any new spending beyond its existing commitments and keeps its current tax rates the same, the federal government is on track to pay back its debt by 2061. (In case you were wondering, the Canadian Taxpayers’ Federation uses the PBO projections to estimate the budget will be balanced only by 2041. So essentially, we are on track for declining deficits for the next twenty years, growing surpluses from then on out, and the entire elimination of the federal debt after twenty years of surpluses.)

Given current high rates of inflation, massive deficits incurred over the COVID-19 pandemic, and general discomfort with debt, many Christians might be wondering how in the world the current governments’ spending can be sustainable.

Let’s break down why the PBO considers Canada’s public finances to be sustainable.

Five Assumptions Behind the PBO’s Definition of Sustainability

The PBO defines fiscal sustainability this way: “that government debt does not grow continuously as a share of the economy.”

Behind that definition is a set of assumptions that are crucially important to understand.

First of all, the PBO assumes that future governments do not incur any additional spending or reduce taxes. Now, future governments will almost certainly spend more or reduce taxes based on their ideology or circumstances. But since the PBO cannot predict what new social programs a future Liberal or NDP government might introduce or how much a future Conservative government might cut taxes, the PBO sticks to evaluating only the programs that governments already have in place – like health care spending, seniors’ pensions, or transfers to other levels of government. Put another way, are the current programs of governments going to lead to perpetual deficits, perpetual surpluses, or some combination of deficits and surpluses? Think of this report as a baseline that future governments will use when they make decisions on whether to spend more or less.

Or think of it like your own personal budget. You can’t predict exactly how much money you’ll make every year in the future or every expense that you’ll incur, but you can foresee the big ones. If you’re looking at your annual budget and see that you won’t be able to balance your budget next month, next year, or in five years, you had better make some changes now to make sure that your spending is sustainable in the future. Think of this PBO report as that personal budget check: is the current lifestyle (without any changes) sustainable into the future? In either case – your own personal budget or the PBO’s analysis – you won’t be able to predict all your expenses in the future. While some people might say that this makes the entire exercise a waste of time or even outright misleading, I’d argue that making a best guess about how your finances will look like in the future and using that information to make changes in the present – whether for yourself or for the government – is a wise and prudent thing to do. Even if your best guess won’t turn out to be 100% accurate.

A second assumption of the PBO is that the best way to measure a government’s level of debt is its debt-to-GDP ratio rather than the absolute dollar figure of debt. Rather than looking at whether the government is a billion dollars, a trillion dollars, or ten trillion dollars in debt, the PBO compares it to the size of the economy. This helps compare how indebted Canada is compared to other countries of other sizes and how provinces compare to each other. We wrote a bit about this in Part 2 of our series Counting the Cost of COVID.

This assumption is based on the logic that, since governments can levy mandatory taxes on the entire economy and theoretically raise as much money as they want, the rate of economic growth is more important than the rate of growth of the government’s debt. If the economy grows at a healthy rate and the government spends exactly as much as it receives in taxes, then the government’s debt-to-GDP ratio improves. Mathematically, this is because the numerator (the dollar amount of the government’s debt) remains the same while the denominator (the dollar amount of all economic activity) grows. This also means that, as long as economic growth outpaces growth in government spending, the PBO considers small deficits to be sustainable. Budgets don’t necessarily need to be balanced in order to be sustainable in the long run.

Speaking of the long run, the PBO’s third assumption in their definition of fiscal sustainability relates to their timeline. They essentially take the current government’s level of debt (39.4% of GDP) and look at their projection of whether the government’s level of debt will be above that or below that in 75 years. If the overall level of debt is less than it is now by the year 2096, then the government is in a sustainable financial situation. If the level of debt is more by 2096, the government is in unsustainable financial territory. The PBO doesn’t take into account what the trendline is now or later. It just compares two estimated points in time.

A fourth assumption is that governments never need to pay down their debt in order to be sustainable. The PBO, like most economists, assumes that governments don’t have a life span. Unlike humans, who generally have about 80 years to live, and who want to make sure that they do not leave debt for their children to pay off, governments are assumed to have an infinite lifespan and so don’t really have to reduce their debt to zero at any point in time. After all, the only way that a government “dies” is through a revolution or conquest, in which case repaying the debt of the old government is the last thing on the mind of a new government.

A fifth assumption is that any surpluses will be used to pay down the government’s existing debt rather than be given back to the people through tax cuts. So, if a government runs surpluses, not only will the debt-to-GDP ratio shrink because the economy is growing, but the ratio will shrink because they also will be paying down their debt. This reduces interest payments and leads to more tax revenue the next year, kicking off a virtuous spiral of exponentially growing surpluses that allows governments to reduce their debt-to-GDP ratio quickly if they get on the right track.

Finally, many assumptions around other variables are baked into the PBO’s fiscal analysis. Although no one can foresee every future event or spending decision, some things are relatively constant or are easier to predict. The PBO includes estimates of the rate of population growth, the aging of the population, GDP growth, and interest rates as best they can and add them to their analysis of current government spending habits.

Overall, the PBO’s report is their best guess of where the country’s finances are heading. It takes into consideration as many variables as it can project with some confidence and ignores variables that it can’t predict very well.

Which Governments Are Sustainable and Which Are Unsustainable?

While the PBO states that the overall combined fiscal policy of the federal and provincial/territorial governments is sustainable, it does look at each government separately to measure its fiscal sustainability.

In their analysis of the federal government, the PBO reports that “current fiscal policy at the federal level is sustainable over the long term… the federal government could increase spending or reduce taxes by 1.8% of GDP ($45 billion in current dollars) while stabilizing net debt at 39.4% of GDP over the long term.”

So, despite Prime Minister Trudeau’s record-setting deficits through the COVID-19 pandemic, the federal government has a fair bit of room to spend more or reduce taxes and still be sustainable in the long run. Again, this might seem absurd, yet under the PBO’s assumptions, it’s a defensible claim.

The PBO can make this prediction largely because the federal government’s tax revenues will grow faster than its expenditures in the long term. Generally, the Canadian economy grows every year and when the economy grows, the government collects more in taxes. Since the government taxes a fixed percentage of the pie, when that pie grows, they collect more money. However, given the types of programs the federal government spends most of its money on – transfers to people or other levels of government, national defence, or national highways – doesn’t grow very much. If revenues grow faster than expenses, eventually the federal government will have a balanced budget again, then a surplus, and eventually no debt if they don’t cut tax rates or initiate new programs. In determining sustainability, long-term trends are more important than short-term changes.

Although the Canada Pension Plan is administered by the federal government, the PBO analyzes it separately. This is because the funds collected and paid out through CPP are kept separate from the rest of the government’s accounts. While many people worry that there won’t be any money in the Canada Pension Plan by the time they retire, the PBO finds that the CPP is also sustainable in the long term. The pension fund will continue to grow, as premiums paid in will outpace the benefits paid out until about 2060, at which point the benefits paid out will outweigh the benefits paid in. By 2096, however, there will still be more money in the CPP investment fund than there is now.

In their analysis of subnational governments, which include provincial/territorial, local, and Indigenous governments, the PBO reports that “current fiscal policy is not sustainable over the long term—albeit to a modest extent… permanent tax increases or spending reductions amounting to 0.1 per cent of GDP would be required to stabilize the consolidated subnational government net debt-to-GDP ratio at 25.4 per cent of GDP.”

The biggest challenge facing provincial governments is rising health care costs due to an aging population. While the federal government’s revenue is projected to grow faster than their expenditures, the same isn’t quite true of the provinces because they are responsible for different types of spending. Health care, in general, is becoming more costly, and an older society requires more health care. Health care costs are estimated to grow as fast or faster than the rest of the economy, putting provincial governments behind the eight ball.

While the provinces/territories collectively are not on a sustainable path, each province is unique. Current fiscal policy is sustainable in Quebec, Alberta, Saskatchewan, and Nova Scotia. Quebec is in the best financial position. Ontario, New Brunswick, British Columbia, Prince Edward Island, Manitoba, and Newfoundland and Labrador, on the other hand, are in unsustainable territory, with Manitoba and Newfoundland and Labrador being in the worst financial shape. These provinces need to either cut spending or increase taxes in order to become fiscally sustainable.

Why should you care?

I hope that this article helps you in three main ways.

First, I hope this article helps equip you to better understand news reports about the government’s spending and equips you to talk about government spending with a basic understanding of the assumptions behind government spending policy under your belt. While we may have many legitimate criticisms about how our governments are spending our tax dollars, we don’t need to be terrified that our federal government is about to run off a fiscal cliff. At least, not unless the federal government make big new structural spending commitments…

Secondly, I hope that this article is an arrow in your quiver to help make the case that your provincial government needs to shore up its finances. Most provincial governments – Ontario, New Brunswick, British Columbia, Prince Edward Island, Manitoba, and Newfoundland and Labrador – are not spending sustainably and need reformation. Conversely, use the fact that the federal government has the room to cut taxes without jeopardizing its long-term financial sustainably to ask your federal representatives to lower taxes.

Thirdly, I hope that this can spark some discussion about the meaning of financial sustainability. The PBO uses one definition but perhaps it isn’t the best definition, particularly given a Christian worldview. But we don’t have a solid and comprehensive definition yet either. If you have a better definition of fiscal sustainability, drop us a line at [email protected] – we’d love to hear your thoughts!